Business Valuation and Exit Advising

We Partner With Million Dollar Brands To Help Them Grow, Scale, and Exit Their Business

Here's Just a Few of Our Teams Portfolio Companies

A PROVEN SYSTEM FOR GROWTH

- **Medical Billing

- *eLearning *

- **Commercial Real Estate

- ***Residential Real Estate

- *Trade Shows/Events

- *Sporting Goods

- **Direct Response

- **Restaurants

- **CPG

- *Corporate Training

- *Document Preparation

- *Medical Equipment

- **Machine Manufacturing

- *Sporting Goods

- *Pet Products

- *Mastermind Groups

- *Supplements

- *Real Estate Training

- *Online Casinos

- *eCommerce

- *Telecom Infrastructure

- *Beauty + Cosmetics

- *Business Services

- **Software As A Service

Roland Frasier

6 INC Fastest Growing Cos

$4B+ Portfolio Sales

7 $1 00M Companies Built

Grant Teeple

Buy + Sell Side Acquisitions

$1 B+ In Transactions

Founder of Teeple Hall, LLP

Ryan Deiss

Founder DigitalMarketer

17 acquisitions + exits

Seven 8-Figure Businesses

Richard Lindner

Operations + Optimization

Leadership, Management

5 Acquisitions + Exits

DeAnna Rogers

Inside Sales, Monetization

Recruiting + Logistics

Live+ Virtual Events

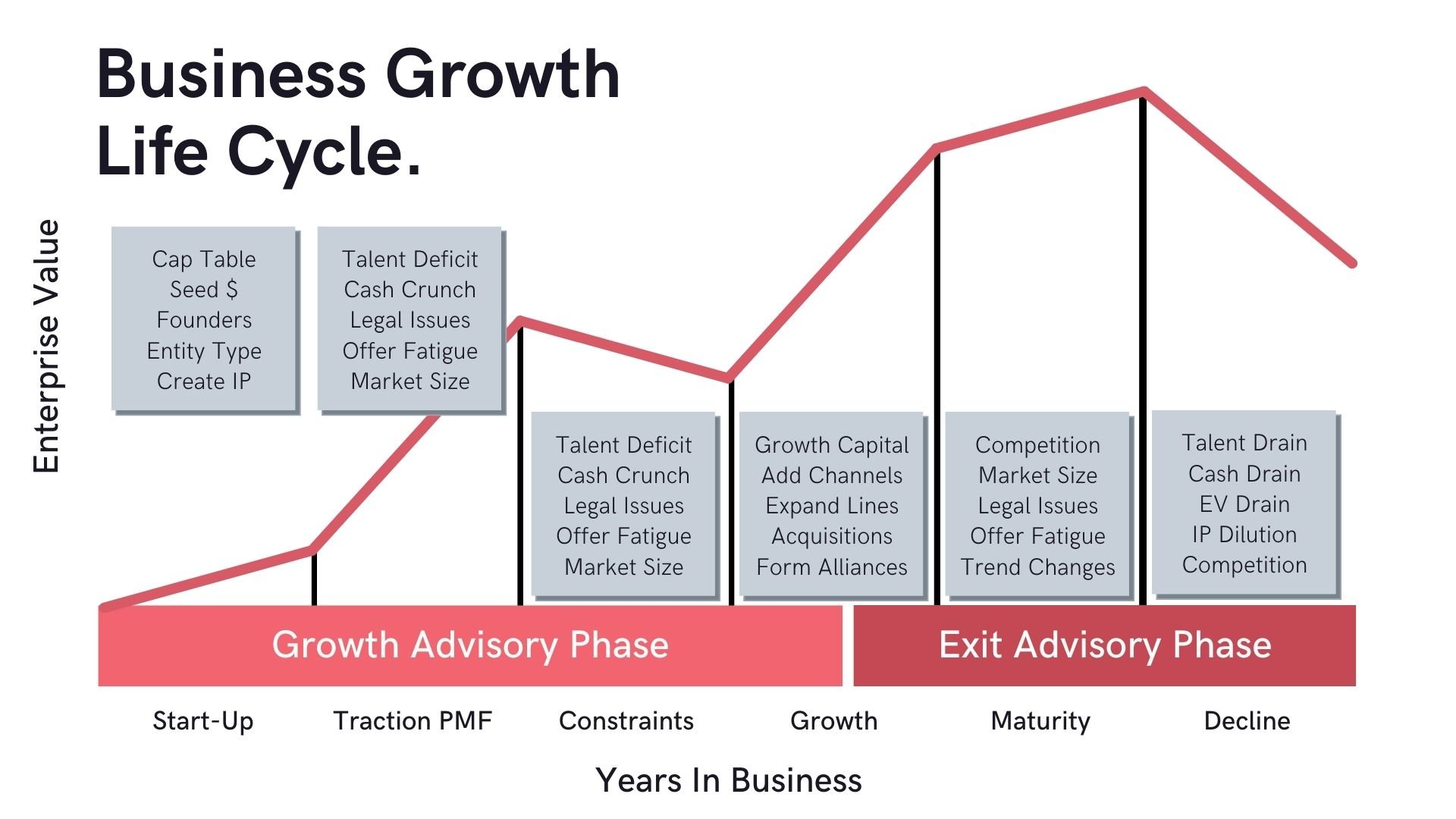

Business Growth Life Cycle

The business life cycle represents the gradual development of a business through distinct phases over time, typically categorized into six stages: launch, traction, constraints, growth maturity, and decline.

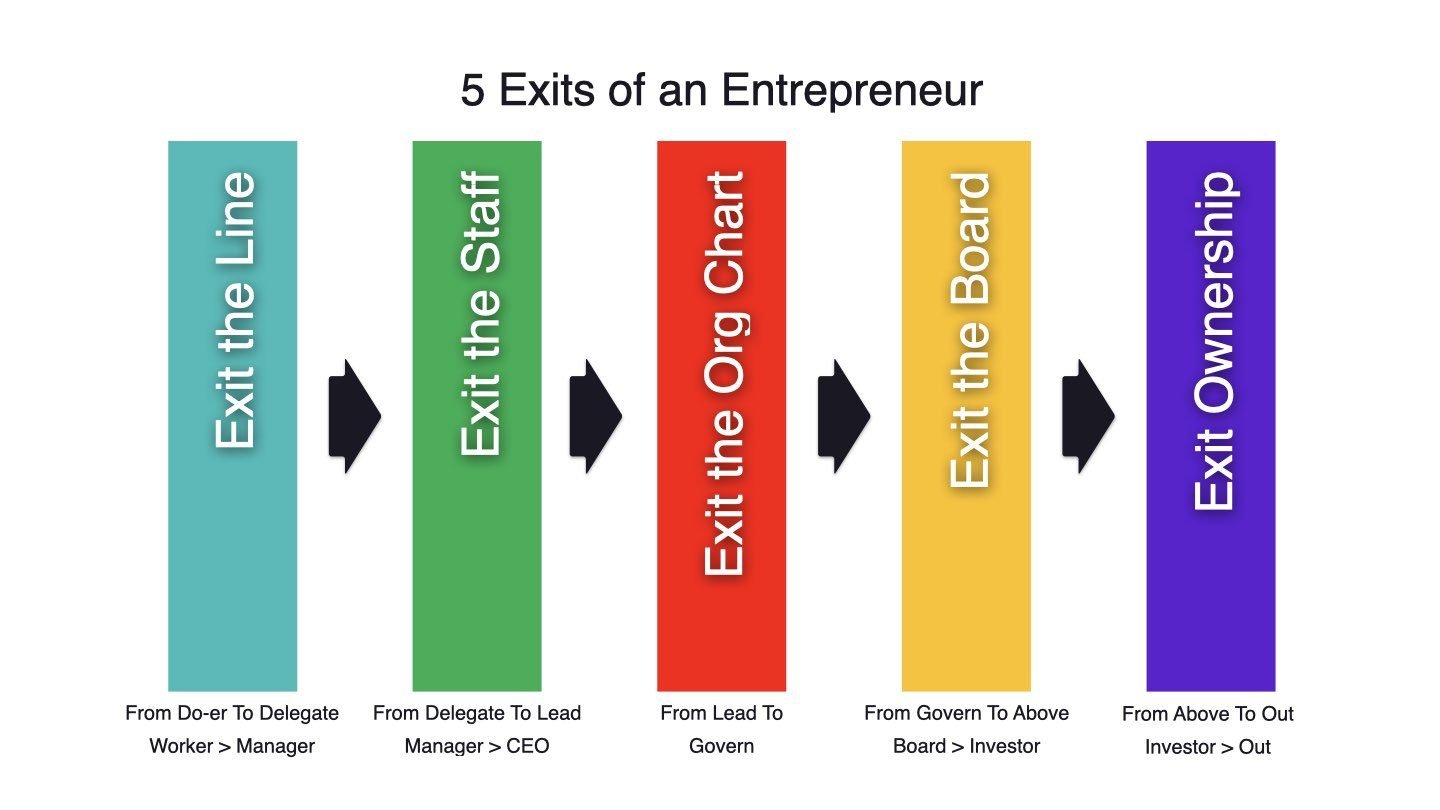

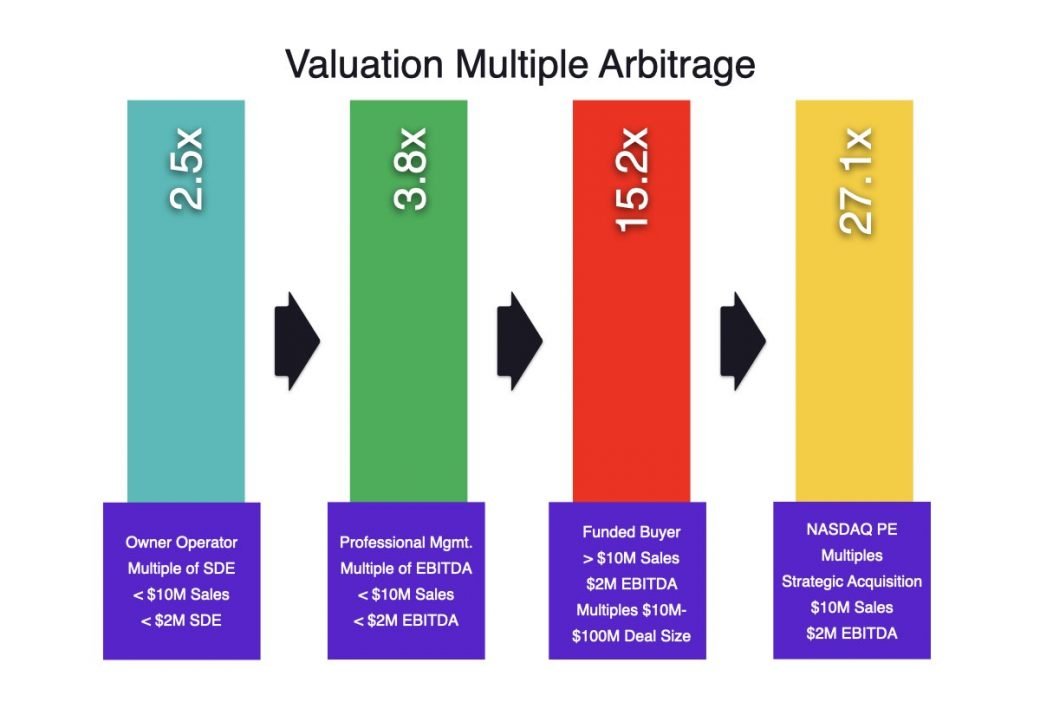

Entrepreneurship is a journey characterized by various experiences, including challenges and successes. One noteworthy milestone is advancing your business. The prospect of exiting might seem overwhelming; however, it’s crucial to explore the diverse exit options and identify the one that best aligns with your goals.

LEVERAGED SALES

Case Study: Transforming a $360k E-commerce Business into a $31M Powerhouse

Background

Our client, a thriving $360,000-per-year e-commerce business, approached us with a vision to scale their operations. Their goal was ambitious: an 86-fold increase in annual revenue. With a solid foundation in digital information sales, the challenge was to diversify their product offerings, implement strategic management practices, and position the company for a lucrative exit.

Challenges

Limited Revenue Stream: The business relied heavily on digital info sales, exposing them to market fluctuations.

Operational Bottlenecks

Inefficiencies in day-to-day operations were hindering scalability.

Leadership Vacuum

The absence of professional management hindered strategic decision-making.

Our Approach

Diversification Strategy

Operational Optimization

Strategic Leadership

Results

Exit Strategy

This partnership resulted in a profitable exit, being acquired by a billion-dollar company. The acquisition marked a milestone in the client’s entrepreneurial journey, providing a substantial return on investment.

Summary

Whether you’re looking to scale, diversify, or position your business for a lucrative exit, our tailored solutions are designed to turn your aspirations into reality. Partner with us, and let’s embark on a journey of unparalleled growth and success.

TRANSFERABLE VALUE

Case Study: Propelling a Digital Publishing Company to New Heights of Success

Challenge

Our client, a dynamic digital publishing company, sought to elevate their performance by achieving significant growth in both revenue and profits. The primary goal was to not only expand the business but also redefine its position in the market while acquiring additional products to enhance overall value.

Strategic Initiatives

Revenue Multiplication

Conducted a thorough market analysis to identify untapped opportunities. Implemented targeted strategies to boost customer acquisition and retention.

Profit Amplification

Introduced innovative monetization models tailored to the digital publishing landscape. Optimized cost structures and operational efficiency to maximize profit margins.

Business Model Repositioning

Evaluated the existing business model and identified areas for enhancement. Successfully repositioned the business to adapt to evolving market trends and consumer preferences.

Product Expansion Through Acquisition

Identified strategic opportunities for acquiring additional products aligned with the company’s vision. Executed successful acquisitions, integrating new products seamlessly into the existing portfolio.

Results

Achieved a threefold increase in annual revenue, reflecting the success of targeted growth strategies.

Witnessed an impressive twelvefold increase in profits, showcasing the effectiveness of optimized monetization models and operational efficiency.

Successfully repositioned the business model, enabling the company to stay ahead of industry trends and consumer demands.

Acquiring additional products led to a substantial increase in overall business value, positioning the company as a key player in the digital publishing landscape.

Summary

Whether you’re aiming to triple revenue, amplify profits, reposition your business model, or expand through strategic acquisitions, our expertise can guide you towards unparalleled growth. Partner with us, and let’s turn your aspirations into a success story that resonates in the dynamic world of digital publishing. Your journey to extraordinary growth begins here.

TRANSFERABLE VALUE

ASSESS

- Tax and Ownership Structure: Aligning Financial Foundations

- Business Model and TAM: Defining Strategy and Target Addressable Market

- Core Beliefs, Values, and Mission: Shaping Organizational Identity

- KPIs, Reporting, and Budgeting: Metrics for Measurement and Fiscal Planning

- Leadership Score and Review: Evaluating Leadership Effectiveness

- Systems, SOPs, and Automation: Streamlining Processes for Efficiency

- Customer Success, NPS/CSS: Ensuring Customer Satisfaction and Loyalty

- Recruit, Train, Comp/Benefits: Cultivating a Skilled and Motivated Team

- Tech Stack and Vendor Analysis: Optimizing Technological Resources

- Review and Assess Cost Structure: Analyzing and Enhancing Financial Efficiency

IMPROVE

- Test Price Increases Analyze

- Price/Margin Pocket Waterfall

- Streamline Internal Costs and Introduce Automation

- Reduce External Costs and Re-Source Strategically

- Optimize Value Ladder and Funnel Structure

- Enhance Creative Development and Targeting

- Explore Additional Media Channels and Increase Spending

- Boost Inbound and Outbound Sales Strategies

- Expand Partnerships, Affiliates, and Referral Programs

- Leverage Earned, Owned, and Paid Media Channels

- Explore Acquisitions for Sustainable Growth

EXIT

- Optimize Approaches to Exit

- Conduct Internal Commercial Due Diligence (CDD), Legal Due Diligence (LDD), and Financial Due Diligence (FDD)

- Review Entity and Personnel Documents

- Identify Potential Buyer Pool

- Prepare Comprehensive One-Sheet

- Solicit Indications of Interest (IOIs) and Secure Non-Disclosure Agreements (NDAs)

- Prepare Deck, Confidential Information Memorandum (CIM), and Data Room

- Negotiate and Review Letters of Intent (LOIs)

- Negotiate Asset Purchase Agreement (APA), Equity Purchase Agreement (EPA), or Share Purchase Agreement (SPA)

- Conduct Buyer Commercial Due Diligence (CDD), Legal Due Diligence (LDD), and Financial Due Diligence (FDD)

- Facilitate Escrow, Close the Deal, and Ensure Seamless Integration